Wyoming Credit Union: Trusted Financial Solutions for Every Need

Wiki Article

Elevate Your Banking Experience With Cooperative Credit Union

Exploring the realm of financial experiences can usually bring about uncovering surprise gems that offer a revitalizing separation from typical economic organizations. Debt unions, with their emphasis on member-centric services and area participation, present an engaging choice to traditional financial. By prioritizing individual needs and cultivating a sense of belonging within their subscription base, lending institution have actually sculpted out a specific niche that resonates with those looking for a more individualized technique to managing their finances. What sets them apart in terms of elevating the banking experience? Let's dive deeper right into the distinct advantages that credit report unions offer the table.Advantages of Cooperative Credit Union

One more advantage of credit unions is their democratic framework, where each participant has an equivalent ballot in choosing the board of directors. This ensures that decisions are made with the ideal passions of the members in mind, as opposed to focusing entirely on taking full advantage of profits. Moreover, lending institution frequently offer economic education and therapy to assist participants boost their economic proficiency and make informed decisions regarding their cash. In general, the member-focused method of cooperative credit union sets them apart as institutions that focus on the health of their area.

Subscription Needs

Credit report unions normally have particular standards that individuals must fulfill in order to enter and accessibility their financial services. Membership demands for cooperative credit union commonly include qualification based upon elements such as an individual's place, employer, organizational affiliations, or various other certifying relationships. Some credit scores unions may serve people who function or live in a specific geographic location, while others might be associated with specific companies, unions, or associations. In addition, family participants of existing lending institution members are typically eligible to join as well.To come to be a member of a lending institution, people are typically required to open up an account and maintain a minimal deposit as defined by the organization. In some cases, there might be one-time subscription charges or ongoing subscription fees. When the subscription standards are fulfilled, individuals can appreciate the benefits of coming from a lending institution, including accessibility to customized economic services, affordable interest rates, and a concentrate on participant complete satisfaction.

Personalized Financial Solutions

Personalized economic services tailored to private needs and choices are a trademark of debt unions' dedication to participant satisfaction. Unlike conventional financial institutions that frequently use one-size-fits-all options, cooperative credit union take a more personalized strategy to handling their members' financial resources. By understanding the distinct goals and circumstances of each participant, lending institution can provide customized recommendations on savings, investments, finances, and various other monetary items.

In addition, cooperative credit union generally offer reduced fees and affordable rates of interest on savings and car loans accounts, even more enhancing the personalized economic services they supply. By concentrating on specific requirements and providing customized solutions, credit score unions set themselves apart as relied on financial partners dedicated to aiding members grow monetarily.

Area Involvement and Support

Neighborhood involvement is a cornerstone of cooperative credit union' mission, showing their dedication to sustaining local campaigns and promoting purposeful links. Cooperative credit union actively join neighborhood occasions, sponsor neighborhood charities, and arrange monetary proficiency programs to enlighten non-members and participants alike. By buying the neighborhoods they serve, lending institution not just strengthen their connections however also add to the general health of culture.Sustaining local business is one more method credit unions show their commitment to neighborhood communities. Through using little organization fundings and economic guidance, credit unions aid business owners prosper and stimulate economic growth in the location. This assistance goes past just monetary help; credit scores unions often supply mentorship and networking possibilities to assist small companies do well.

Additionally, credit scores unions often participate in volunteer job, urging their members and workers to repay via different area service tasks - Hybrid Line of Credit. Whether it's taking part in neighborhood clean-up occasions or organizing food drives, cooperative credit union play an energetic role in enhancing the lifestyle for those in need. By focusing on community involvement and support, credit report unions genuinely personify the spirit of teamwork and mutual support

Online Financial and Mobile Applications

In today's digital age, contemporary financial eases have actually been transformed by the extensive adoption of on-line systems and mobile applications. Credit unions Federal Credit Union are at the forefront of this electronic change, supplying members safe and convenient ways to manage their finances anytime, anywhere. Electronic banking services given by cooperative credit union allow members to examine account equilibriums, transfer funds, pay costs, and watch purchase history with just a few clicks. These systems are designed with straightforward user interfaces, making it very easy for participants to navigate and gain access to necessary banking features.Mobile apps supplied by credit history unions further boost the financial experience by giving extra adaptability and access. Members can perform different financial tasks on the move, such as depositing checks by taking a picture, obtaining account notifications, and even contacting customer assistance straight with the application. The safety of these mobile applications is a top concern, with attributes like biometric authentication and security methods to protect delicate details. In general, credit unions' electronic banking and mobile apps empower participants to handle their financial resources effectively and safely in today's hectic electronic globe.

Conclusion

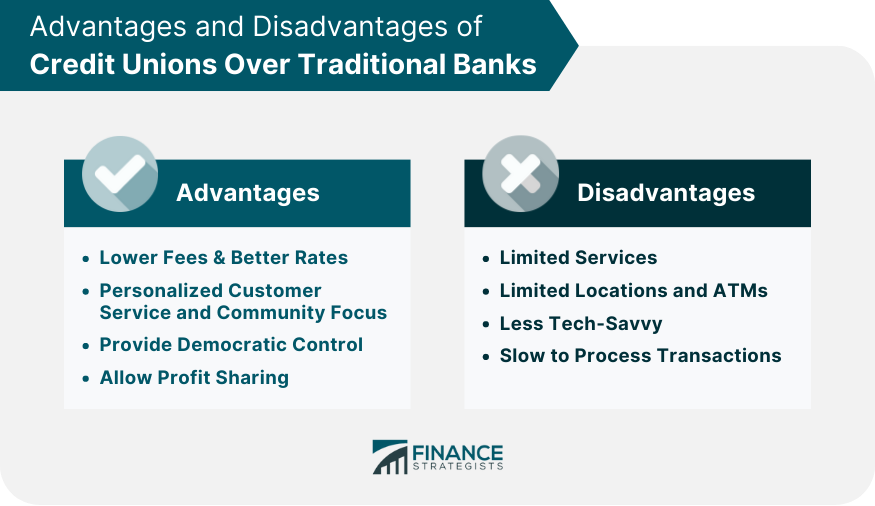

To conclude, credit history unions use an one-of-a-kind financial experience that focuses on area participation, tailored service, and participant satisfaction. With lower charges, competitive rates of interest, and tailored financial services, cooperative credit union cater to specific demands and advertise monetary well-being. Their democratic framework values member input and sustains neighborhood communities with various efforts. By signing up with a lending institution, individuals can raise their banking experience and build solid connections while taking pleasure in the advantages of a not-for-profit monetary organization.Unlike financial institutions, credit history unions are not-for-profit organizations had by their members, which commonly leads to lower charges and much better rate of interest rates on cost savings accounts, finances, and credit cards. Furthermore, credit scores unions are recognized for their personalized client solution, with staff participants taking the time to recognize the distinct financial goals and obstacles of each member.

Credit rating unions usually offer financial education and learning and therapy to assist members improve their economic proficiency and make notified decisions about their money. Some credit unions may serve people who live or work in a certain geographic location, while others might be affiliated with particular companies, unions, or organizations. In addition, family participants of existing credit union participants are typically eligible to sign up with as well.

Report this wiki page